Bitcoin, Explained

An article about Bitcoin. Bitcoin is one of the first digital currencies to use peer-to-peer technology to facilitate instant payments. Ryan explains it so a five year old could understand it.

By Ryan McGrory

Preface

Hi, my name is Ryan. I am a computer science student at the University of New South Wales. I am creating this article to highlight my journey in learning more about cryptocurrency, what is it? Where does it come from? Why is it useful? Why is it all over social media?

As a computer student who is passionate about all fields and branches of the subject, I feel I have a good inclination to the idea of cryptocurrency, or more aptly referred to as blockchain technology, however, I will be creating this article to iterate over the fundamentals of this subject for interested readers. The intention of this article is to explain cryptocurrency and relevant subjects in a fashion of how I would of liked them presented to me. Cryptocurrency is a super cool topic and with some simple analogies the concept can be easily explained. For readers who have technical experience or classify themselves as technically savvy, this article may be more of a ‘skim’ read but you may learn some new technical knowledge of the ins and outs of cryptocurrency, or improve your current understanding.

If you plan on purchasing cryptocurrency, please be careful with how you use it. If you send it in a transaction, be sure it’s the place you want it to go to, you won’t be getting it back otherwise (can’t call the credit card company of Bitcoin), all transactions are irreversible. As will be discussed, cryptocurrency has strong affiliation with illegal activities, a lot of places which accept Bitcoin have a higher chance of being a scam. Be careful and stay safe!

This article will mainly focus on the properties of Bitcoin and its Blockchain, however, there will be references to other types/systems of blockchains. If you have no idea what any of these words mean, don’t worry! This is what this article is here for and you will be learning something new!

What is cryptocurrency?

Cryptocurrency: a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank

So to begin, here is a definition of cryptocurrency, this definition can be broken down to 3 main points:

-

A digital currency -

Techniques used to regulate generation of currency and verify transfer of funds -

Operating independently of a central bank

These are the main ideas that need to be discussed to have a good understanding of what cryptocurrency is and how it operates.

Digital Currency

As you may have guessed by the name, ‘Cryptocurrency’ is a form of currency, exactly how you would have cash in your wallet. The reference to similarities between cash that you use in everyday life and cryptocurrency will be returned to regularly. Most people store their cash in their wallet, along with their license, gift cards, membership card to the gym and a photo of their pet dog. Similarly, online, cryptocurrency is stored in ‘wallets’. Seems super similar? It is!

In order to obtain this currency, it is exactly how you would obtain cash in real life. You may work for someone and they can pay you in the form of cryptocurrency or more likely you can go to a currency exchange.

Imagine you are trying to get American Dollars ($USD) with your Australian Dollars ($AUD), in order to make the currency conversion, you go to an exchange, see the exchange rates and give the teller your money to receive the $USD.

This is the exact same for cryptocurrency, you go onto the internet and transfer the currency from your Australian Dollars ($AUD) to Bitcoin (BTC). Bitcoin is one of the main well-known cryptocurrencies and we will be referring to it throughout this article. Bitcoin is just another form of currency, it holds value and is able to be traded for other currencies or used to purchase goods and services. So now you have Bitcoin! You can use it to purchase things online or use it as a portfolio asset and buy/sell as you desire. These are the fundamental basics of cryptocurrencies, it is an online currency.

Techniques used to regulate generation of currency and verify transfer of funds

So without any authority to manage transactions and maintain authenticity, what methods does cryptocurrency incorporate to replicate this without an assigned central authority?

As we are focusing on Bitcoin, we will use its structure to explore the fundamentals of how cryptocurrency operates. Different cryptocurrencies have different systems in place.

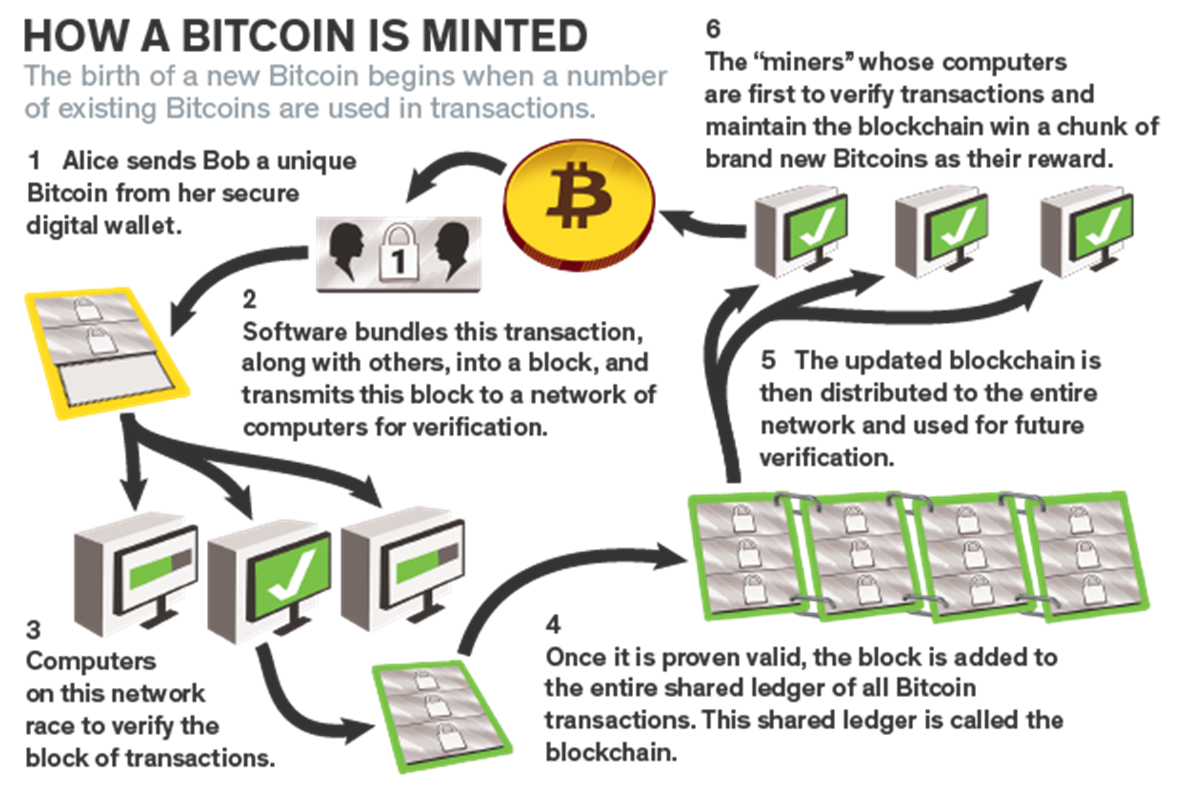

So Bitcoin’s unique structure is integral to how it originates and how it is maintained. Cryptocurrency is produced as a reward to ‘miners’, the role of miners is to verify transactions presented in a ‘block’. The miners are paid to verify the transactions in the economy and this cycle is perpetuated. The system consolidates a group of transactions and miners verify that the block is legitimate (the wallets who are sending money possess the money to send and it is going to valid places), this is what is referred to as the ‘Blockchain’. This can be assimilated to a bank transfer, the bank checks that your account isn’t empty, and that the money is going to a legitimate account (in case you entered incorrect details of the recipient).

Once the blocks have been processed by the miners and have been checked to be legitimate, this information is stored by a lot of different people around the world. This is a failsafe to prevent someone from fraudulently editing the ledger (record of financial information) to create money (bitcoin) or transactions that don’t exist. By having extensive copies of the ledger, one party is unable to improperly manipulate the data. Of course, if someone did manage to obtain 51% of the ledgers (51% attack) which record Bitcoin transactions, someone could hypothetically falsify transaction records, however, this is extremely unlikely due to the number of copies.

As each ‘block’ is mined they are ‘linked’ together, hence the name ‘Blockchain’. If you imagine a metal chain, you can symbolise the links in the chain as being the ‘blocks’, once a block is verified by a miner it is added to the chain and this chain is unbreakable. This link is created through the use of encryption and if you are interested in the specifics, research SHA-256 encryption, it will be discussed in light detail further down.

For every ‘block’ that is mined, bitcoin is given to the miner, this is similar to a mint producing cash. The miner also obtains any transaction fees present in the block as well as this new Bitcoin, the transactions fees are paid by the people who are sending money. When you create a bitcoin transaction you specify the additional amount to the transaction, the higher this fee amount, the faster the transaction is processed (Miners will prioritise blocks where they are paid more for processing). Bitcoin is a capped market, meaning that there is a limited number of bitcoin in the market. The amount of the bitcoin in the economy is equal to the amount of bitcoin ‘mined’ since its existence/operation. There will be a time when Bitcoin is no longer rewarded to the miners (injected into the economy) and the effect this will have on the currency is largely speculated. Due to Bitcoin being capped, valuation is determined by classical economic demand and supply theory. The value of Bitcoin will be discussed further down in the article.

The general idea of the linking of the blocks seems quite mystical, so I will provide an explanation that you can tell your friends so they get off your back about this mystical unbreakable chain. When the miners record transactions that have been made (but not yet verified), they are given the ‘hash’ of the previous block in the chain and the ‘hash’ of the transactions in their current block. A hash is a mathematical operation where given an input a unique output is created of a set length

1234 -> 10

Here the hashing algorithm is the sum of the inputs, it produces an output of set length [2]. This is the general idea of hashing, however, there would be multiple sequences of numbers which can be inputted to give ‘10’ which is called a hashing collision, which is avoided with professional hashing algorithms. Hashing is very efficient, however, it is very computationally expensive to attempt to reverse a hash,

i.e. 10 -> 1234 (even though we know this is problematic because there could be multiple input sequences).

The purpose of hashing is to link together the blocks. By having hashing iterations, where we run the hash algorithm multiple times, it makes it difficult to determine what the ‘original’ input was, making it difficult to alter or fraudulently impact the blockchain.

If we have 123456789 hashed 2 times 123456789 -> 45 -> 09, this makes it very difficult to determine what the original sequence of input was. As the blocks use the previous blocks hash and its own transaction information, this aggregate hashing makes it very difficult for blocks to be falsified as the reverse computation of the hashes is extremely expensive. As the reverse computation process is extremely expensive, legitimate miners can progress the blockchain before a malicious party is able to attempt to reverse a hash.

An analogy for this is that in order to get into a locked door, you need the key, but the manufacturing of the locked doors is every second… By the time you manufacture a key, another 50 locked doors have been made past the one you just unlocked.

To summarise, these legitimate miners hash the blocks at a rate which makes it extremely difficult for individuals to attempt any malicious activity.

So this is how Cryptocurrency, specifically Bitcoin, is created and maintained independently of a managing authority. Transactions are made, miners verify these transactions and are rewarded for the work they do in verifying these transactions and the cycle repeats.

Operating independently of a central bank

As we previously discovered, due to the structure of Bitcoin, the system operates without a managing authority. The possibility of this concept has been greatly appraised as it allows individuals to consent to transactions without the fear of being exploited or somehow deceived. This has expanded the range of activities that people are able to do without ever having to meet or know each other’s details. One of the current major uses or greatest market demand for this type of currency is the dark web, as it allows people to transfer funds without having to reveal personal details. The ‘dark web’ is used to refer to the section of the internet where illegal practices/trades occur. So Bitcoin does have a practical purpose in the sense that there is demand created by dark market activities.

The fact that the currency operates independently of a managing authority raises many challenges for governments and controlling bodies who are required to track the flow of funds. As previously stated, all Bitcoin transactions are publicly recorded, and if you are interested you are able to follow these transactions all the way to where first transactions were made, however, even though you are able to track the flow of the currency, it is difficult to determine who’s transactions they are, as there are no details associated with transactions only the sender, amount and recipient.

Despite this being challenging for governing authorities, this independence allows for greater financial freedom for individuals.

Cryptocurrency as an asset

Now that we understand what Cryptocurrency is and how it generally operates with varied structural niches forming following the creation of Bitcoin, we can assess its value (or lack thereof).

Economic principle states that price is determined through level of demand and level of supply. If there is huge demand and little supply, the price will be greater. Comparatively, if there is low demand and high supply, the price will be low. These are the natural forces which equate to determine the price of Bitcoin and other cryptocurrencies (commonly referred to as the price mechanism). As previously mentioned, Bitcoin is a capped market, meaning there are a limited number of Bitcoins existing in the market at any one time. This means supply is limited to a certain extent, the coins that don’t exist in the market cannot be sold. So, if there is greater demand for Bitcoin, the supply is limited, causing an increase in the price.

Demand of the currency originated through genuine demand and speculation. I use these two categories to reflect how currency is used by individuals/parties. Most ‘genuine demand’ is sourced through dark web transactions and this is how Bitcoins value began to grow after its creation and then widely adopted in darkweb markets. This lead to the stable growth of Bitcoin as more people used the currency, the currency had greater demand, increasing its price. In 2017, the currency experienced a large valuation spike from $1200 AUD (JAN 2017) to $20,000 AUD (2018 JAN) , due to the previous trend of the currency value, I believe this is disproportionate to the ‘genuine demand’ of the currency, as demand increasing exponentially is unlikely. The predominant force of this spike I believe is speculative investment. The currency received a large amount of media attention with the traction of its value and its upward trend catching the attention of investors and spectators alike. As demand increased for the currency the price of bitcoin went up dramatically. This price later fell 73.5%, to $5300 AUD (DEC 2018) reflecting the volatility of the currency, dangerous for investors managing large capital.

Issues with Bitcoin

Let’s discuss some of the major short-falls of Bitcoin beginning with real world cost (or public cost):

- Highly fluctuating

- Lack of managing authority

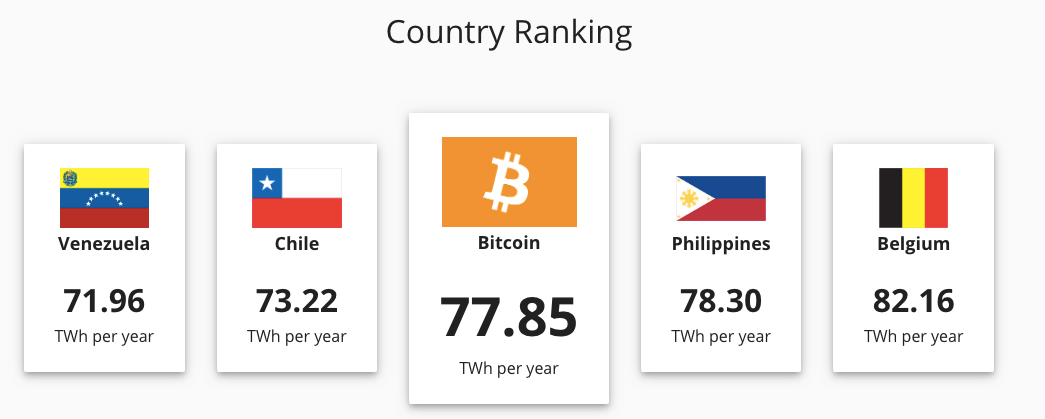

- Bitcoin consumes an estimated 0.17% of global power production. This is due to the mining process previously explained. There are a lot of computers used to mine, a lot of power is consumed in order to create the blocks and perpetuate the currency. The cost of this energy consumption is almost unfathomable, the Bitcoin economy consumes roughly twice the amount of power of New Zealand [ 😱 ].Contributing to the effects of global warming and other consequences due to the use of fossil fuels for energy production.

(fantastic website to explore about Bitcoin power consumption - Cambridge Bitcoin Electricity Comparisons)

- Bitcoins genuine demand is sourced from black-market needs. Until the currency is properly implemented in contemporary society where you can use the currency to purchase goods and services (which is unlikely until the government can facilitate the currency for financial records , which would be expensive to implement) the demand for the currency will continue to come from the purchase of goods and services which are illegal or for the illegal flow of currency.

Strengths of Bitcoin

Some of Bitcoin’s greatest short-comings are a part of its greatest strengths:

-

The anonymity of the currency is one of Bitcoin’s greatest strengths. For a long time online there was a shortfall between anonymity and trustworthiness. Bitcoin has become a bridge for these two traits, where senders never have to reveal information that may expose one’s self, but the two parties are able to trust each other knowing that these transactions cannot be falsified, reducing the potential to be scammed. Of course, there is still a high chance of being scammed in such a way, however, it is at the parties discretion to authorise these transactions.

-

Bitcoin has become a facet of the internet freedom movement where individuals are able to operate freely from the surveillance of government and large organisations, incredibly powerful for citizens of countries where they face strict governmental impositions as well as your average western citizen.

-

Transactions are extensively tracked and documented by the ledger allowing for the transparent viewing of financial flows on the network. This is a major benefit of most blockchain technologies.

Summation

Bitcoin is a part of a new and upcoming genre of technology which is powerful and super interesting. Blockchain technology is seeing increasing investment into research as governments and companies alike are delving into how they are able to incorporate this technology to create more efficient, transparent practices. As of the publication of this article, the Australian government is continuing research into a potential national blockchain type currency, if implemented, would be the first country to make such a move. Interestingly the people tasked with this practical application research is CSIRO’s technology arm, Data61, who have an office right at home at UNSW!

Bitcoin, originally created by the unidentified party, Satoshi Nakamoto, continues to grow and spark technological advancements. These people or person who are responsible for such amazing work might never receive acclamations, continuing in the fashion of the late Alan Turing. Incredible technological discoveries without self-popularisation.

All opinions in this article are independent of UNSW and CSESOC and are solely of the author.